The refrain from the left is that the “rich” need to pay their “fair share” as if they aren’t paying taxes. Let’s take a look at what that means.

The top 1 percent of taxpayers pay nearly double the income taxes than the bottom 90 percent. The top 1 percent of taxpayers paid more than $1 trillion in income taxes while the bottom 90 percent paid $531 billion.

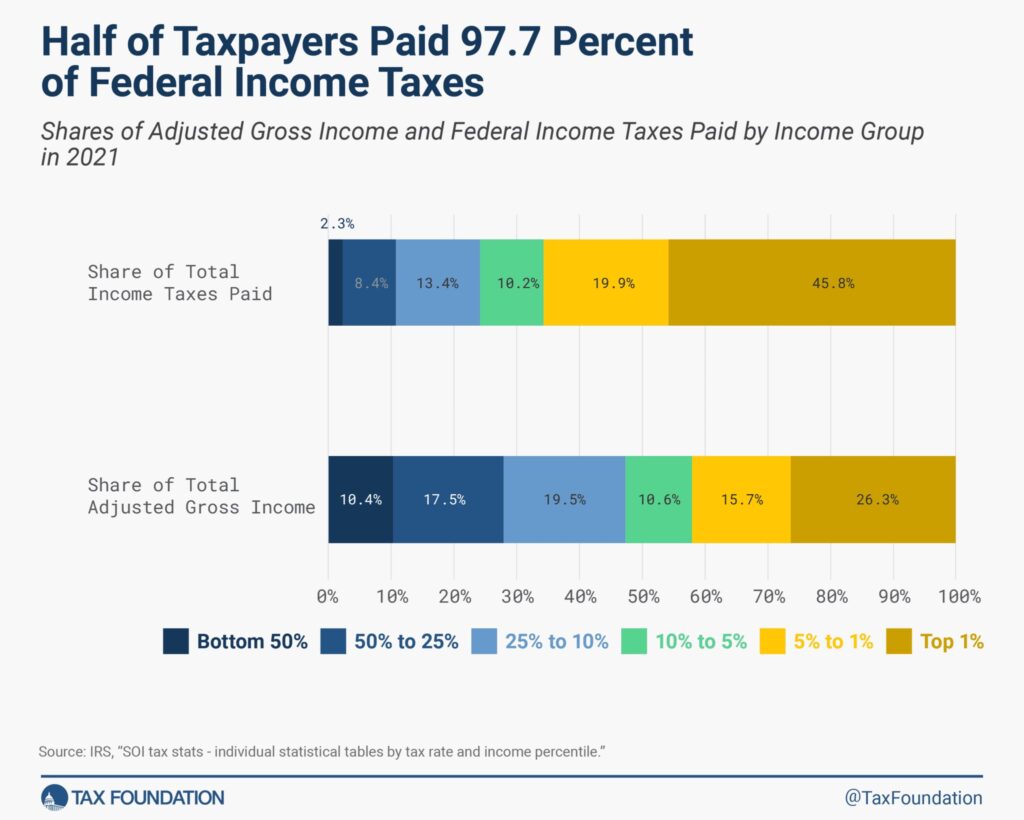

The share of income taxes paid by the top 1 percent increased from 33.2 percent in 2001 to 45.8 percent in 2021. Over the same period, the share paid by the bottom 50 percent of taxpayers fell from 4.9 percent to just over 2.3 percent in 2021.

That’s right- the lowest 50% of wage earners paid just 2.3% of all income taxes, while the top 25% of wage earners pay 89.3% of them.

So just how much do you have to make to be in that upper 50%, or upper 25%? To be in the top 50%, a taxpayer must earn at least $46,637 per year. In order to be in the top 25%, a taxpayer would need to make $94,440. The top 25% isn’t all that rich- there are tons of people like nurses, firefighters, restaurant managers, electricians, and auto mechanics who fall into that top 25% category. The top 10% of wage earners? Those are people making $169,800 or more. Those are your doctors, chiropractors, accountants, lawyers, and many entrepreneurs. Successful, to be sure, but hardly evil people playing the part of Ebenezer Scrooge.

The left claims that they are only going to raise taxes on people making more than $400,000 per year. That is the top 3% of all wage earners, a group that is already paying more than 24% of their income on taxes, and who are already paying 60% of all Federal income taxes.

Even if we were to confiscate every penny made by the top 5% of earners, the government would only get $6.1 trillion. Since the government spends more than $6.2 trillion a year, that amount wouldn’t even be enough to run the government for the year, and I guarantee you that those wage earners wouldn’t be there to fleece next year.

No, when the left tells you that they want to increase taxes, they mean for everyone. Of course that won’t affect them, because they are getting a cut for themselves. You didn’t think that those billions going to Ukraine were all for beating Russia, did you?

20 Comments

dc · October 16, 2024 at 8:08 am

Our betters want everyone to be enslaved to the banks and the taxman. Sure, you can buy a half million dollar home, but even if you pay off the mortgage, you will still owe a thousand dollars a month to county taxes not even mentioning insurance. Frustrating.

Dirty Dingus McGee · October 16, 2024 at 8:10 am

Silly man, trying to use facts to counter “muh feelz”. As someone who has been getting hosed by paying well over what I consider to be my “fair share” for nearly 20 years, I have decided enough is enough.I sold out my share of the business so after this final tax hit, the government will no longer get squat from me. In fact, they will now be paying ME, I filed to draw Social Security. I’m not a fan of the SS Ponzi scheme, but being as it has robbed me for over 50 years, I want that money back.

oldvet50 · October 16, 2024 at 9:10 am

It’s the same old story that’s been circulating for decades. Unless things have changed at the IRS, they treat corporations and private individuals alike. When a politician says they will only tax earners making over some ridiculous amount of money, they are including businesses. Most people cannot grasp the fact that it is impossible for a business to pay tax. Tax is an expense to a business and is paid by the consumers of their goods or services – always. It’s like a renter voting for property tax increases since he doesn’t own property.

TakeAHardLook · October 16, 2024 at 10:44 am

What’s your “fair share”? The demo-communists use that term constantly–ad nauseam–and its translation is: “Everything you’ve got.”

Meanwhile, those in charge of FedGov have many ways to keep their own ill-begotten money: bribes, lobbyist gifts (pay per vote), insider trading, etc. Stuff that We, the People will go to jail for doing.

Years ago there was a joke about Bill Clinton’s IRS:

Here’s the Clinton Form 1040 Ultra Short Return:

1. How much did you make last year?

2. Send it in.

If they declare martial law or we devolve into CWII the first things that will stop hard are income tax returns.

Skyler the Weird · October 16, 2024 at 11:52 am

The same Democratic Party campaign rhetoric since 1933, except due to Government caused inflation, they’ve replaced the word tax the Millionaires with tax the Billionaires.

Mr._Garibaldi · October 16, 2024 at 1:10 pm

I don’t want to change the subject much, I’m about to enter the labor marker as one of the 25 – 10% earners. IF Kamala get in and passes any type of unrealized gains tax on earners and businesses worth 100 million or more I would probably see a 40-60% reduction in my salary putting me in the lower 25% to upper 50% earning bracket, at the very least. The very worse would be pink slip. Taxes, taxes, and more taxes with a whole lot of unemployment thrown in.

Fair share in the US is about to be the equivalent of EU tax levels, where earners of 80k or more pay 60% in tax.

Pete · October 16, 2024 at 3:51 pm

People think multimillionaires just have a stack of cash in a back room that they swim around in, but most of that money is out doing work, it’s already spoken for.

Payments on their corporate buildings, payments to vendors, payroll for their employees, payments on the guy’s boat or whatever…and yes, quarterly tax payments.

If you raise someone’s taxes by $400k a year, do they really think the guy will just angrily kick a rock and say “oh well, I guess I have to sell my boat?” No, he’s going to lay off four people who were making $100k a year.

Divemedic · October 16, 2024 at 4:41 pm

I am in that awkward place where I make enough to owe a lot in taxes, but not so much that I can find a lot of tax shelters to avoid those taxes.

Jonathan · October 16, 2024 at 6:43 pm

They SAY the will only tax the rich because they don’t think we’re smart enough to do the math.

I make good money, well into the top 10%. Last year I paid 9% in taxes – a good accountant and tax professional is VERY worth the money.

Anyone who doesn’t put up the relatively small cost for one is shooting themselves in the wallet.

Dan D. · October 17, 2024 at 9:31 am

I second this statement. I was told this very by a wealthy relative in the late 1980s; a good accountant will save you more in tax avoidance than their cost. And especially if they are, say, of the Hebrew persuasion.

Jonathan · October 18, 2024 at 8:41 am

My first professionally prepared taxes cost me $120 and saved me $1200 over doing it myself.

My record is a $70 fee saving me $60,000 (that was my best year for income, probably ever)

Birdog357 · October 23, 2024 at 7:53 am

I don’t make enough to even bother itemizing. I get the best return using the standard deduction. My tax burden is over 25%….

Divemedic · October 23, 2024 at 7:56 am

Up until now, I have never itemized, either.

I am going to this year, because we have mortgage interest and taxes on the new house, so that is going to change things.

JimmyPx · October 16, 2024 at 8:58 pm

The TRULY wealthy (ie billionaires) ALL have the vast bulk of their money in “charitable trusts”.

I’ll bet $1 that most of us pay more in income taxes than Oprah.

It’s a big scam, for example the private jet is owned by the trust. If I want to fly to the Super Bowl, we take the jet and then cut a check for $10,000 to some local charity and it’s all good.

Never buy the BS that people like Bill Gates is a philanthropist rather he is hiding his money from the taxman. My uncle was a NYC lawyer who specialized in creating trusts for wealthy people and they ALL do it (like 100 million+ club).

The thing is these people are the donor class and own the politicians. The politicians will never EVER get rid of charitable trusts any more than they will get rid of their “legal” insider trading.

So “tax the rich” means you and me and people like doctors, lawyers and small business owners.

Trotsky's Pick Axe · October 17, 2024 at 6:31 pm

Jank Yogurt of the Young Turks revealed that comradette AOC is an actor that answered an ad and I love that clueless tax the rich in a multi-thousand dollar dress at some ball.

May her bearded Irishman boyfriend take it out on that good and hard on that bearded taco.

She also said that complainers are the useless eaters howling from the cheap seats but her constituents are all burrito goblins AKA not all that bright.

How much are you entitled to someone else’s labor and money?

Exactly zero with the rights to nothing.

If they part with some out of kindness and generosity then be most thankful and do what you can to pay back.

Differ · October 17, 2024 at 7:28 pm

It would be nice if for a change a candidate said we’re.not going to increase taxes, but we shall be cutting spending….

Wishful thinking.

Tsgt joe · October 18, 2024 at 11:19 am

That fair share thing is pure emotion. My thinking is that “fair” would be that we all pay the same proportion of our income. Lets say 10% of all income over $50,000, no deductions for anything. I’ve heard that would net the Govt. more $ than the current system but I’ve had more than one person get upset because somehow the rich wouldn’t pay their “fair” share. Another concept the same folks have a hard time with is that businesses don’t actually “pay” taxes, it’s all a cost of business that’s passed on the consumer.

Divemedic · October 19, 2024 at 7:37 am

Ten percent of income over $50k won’t work. The 50th percentile is $46k per year. The upper half of taxpayers, making more than $46k per year, pay 16.2 percent of their income in taxes. The lower half pay 3.3 percent.

There are 76.7 million people in the US who make more than $46k. They pay a total of $2.142 trillion in taxes, which works out to just shy of $28,000 each. That mythical person making $50k would have to pay more than half of what he makes for this proposal to bring in the same income as the current tax structure.

What our government has is not a problem with income- they get plenty of money. What they have is an out of control spending problem.

Birdog357 · October 23, 2024 at 7:56 am

Maybe we need to make the people on the bottom pay their fair share then?

Divemedic · October 23, 2024 at 8:04 am

In order to balance the budget, every single person in the nation would have to pay 29.3% of what they make in income taxes.

Then next year, more spending would mean higher taxes. It will never end, because politicians are buying your vote with your money, plus feathering their own nests with money they skim off the top.

Comments are closed.