In a follow up to the credit card post, let’s look at the math of credit card rates. Interest rates on credit cards only matter if you carry a balance on them. Nearly half of credit card holders (47%) carry a month to month balance. Who carries this balance?

- more than half of Gen Xers (ages 46-61; 53%)

- millennials (ages 30-45; 53%),

- 2 in 5 boomers (ages 62-80; 43%)

- Gen Zers (ages 18-29; 40%)

The average balance for credit cards where the owner does carry a balance is $6700.

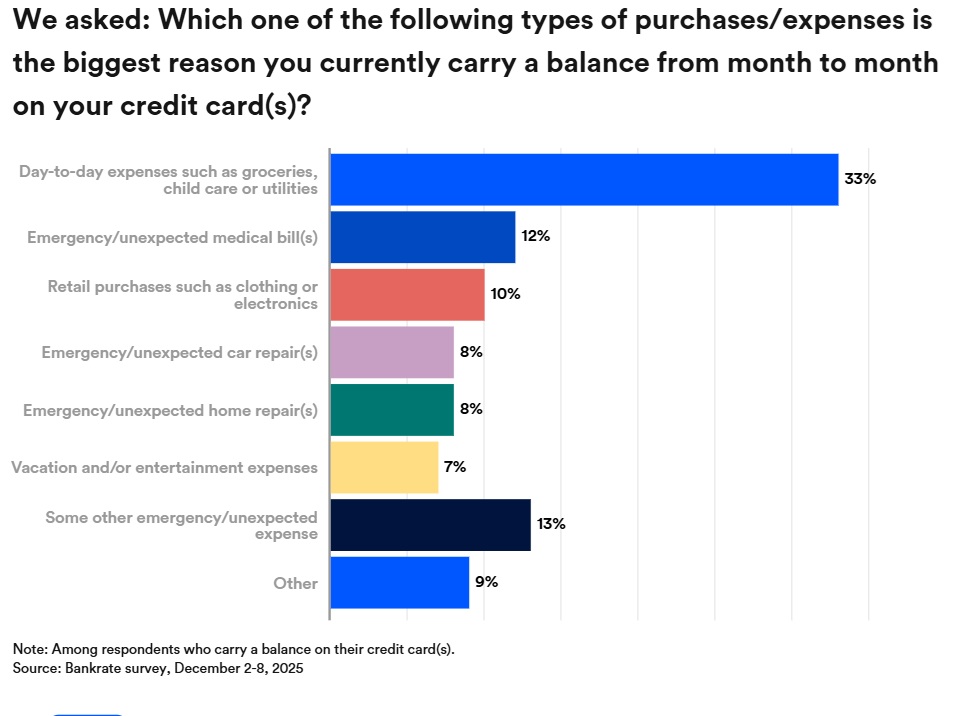

Why do the users carry a balance? The largest single reason is they aren’t properly managing cash flow and spending beyond their means, which forces them to use credit cards for everyday expenses.

According to the Federal Reserve, 82% of American adults have at least one credit card. However, it’s common to have several cards in your wallet. On average, people have 3.9 cards.

My wife and I are super prime users, and we spend about $40,000 per year on credit cards. We use them for everything: utility bills, groceries, you name it. Once, I even made a $20,000 down payment on a car with a credit card. The difference is that we pay the balance off every month. Why do I do that? Rewards.

My Amazon card pays 5% cash back. Our joint card that we use for daily expenses? 5% cash back on fuel and restaurants, and another card gives us 7% credit for use on vacations. It’s all about maximizing our cash back returns. It’s like giving yourself a raise. As for us, that $40,000 a year in card use gets us about $1500 a year in rewards and freebies.

You just have to make sure you don’t carry a balance. That means spending within your means and not carrying a balance. The nationwide average APR on general-use credit cards is 21.91%, which means interest adds up quickly.

Among those who carry a balance, more than 7% of them are more than 90 days past due. So do the math from the other post- people with lower credit scores (below 700) spend the least, but are the most likely to carry a balance and most likely to become seriously delinquent and default.

So Trump’s rule of requiring credit card rates to be capped at 10% will cause credit card limits and availability to be greatly restricted. People will move back to cash, and will have to use debit cards for online transactions. This will in turn do three things:

- It will force people like me to stop taking advantage of rewards, because they will no longer be available. I, and other prime and super prime users, will have to switch back to cash.

- Prime users with scores between 700 and 749 will have restricted access to cards, and even then, those cards will have very low spending limits, likely $1000 or less.

- Credit cards will simply not be available to those with a credit score below 700. This will force these subprime borrowers into more expensive payday loans, which carry interest rates of more than 300%.

The hit to online vendors and shopping will be enormous. Amazon, as the world’s largest online retailer with $400 billion in annual online sales, will be especially hard hit as people lose access to easy digital funding sources.

Likely, this will eventually settle into digital currency becoming more popular. At that point, I will have to reevaluate my opinion of things like bitcoin.

Just remember- price controls NEVER work as intended. Where there is market demand, the market will find a way to supply that demand.

30 Comments

Joe Blow · January 13, 2026 at 5:25 am

I don’t disagree with your assessment. I think however there’s something else we’re not aware of. Not sure what. Big-banks donate a lot of money to politicians, they’re not going to screw with them. I concur the math doesn’t math at 10%, so… what?

I see a lot of these installment-loan type programs at every retailer (even for 10-dollar items), that could be something? But it won’t replace CC’s… Methinks they’re TRYING to push the consumer over the tipping point. This is just one of the tools they’re using. Too early to be a mid-term gambit.

toofaraway · January 15, 2026 at 10:09 pm

fwiw, i’m so old i can remember when credit card companies were quite profitable @ 10% interest, thank you.

Divemedic · January 16, 2026 at 5:07 am

That was before everyone got a card, regardless of credit history. In order to be profitable at a 10% rate, defaults have to be much lower than they are. That means FICO Scores below 750 to 760 need not apply.

Toofaraway · January 16, 2026 at 12:09 pm

i’m sure you’ve read them description, debt slave.

there was a band, that still tours these days, that named one of their album’s What Were Once Vices Are Now Habits.

a few years later a new member of the band wrote a song “ How Do The Fools Survive “.

i realized quite a lot when i first read a quote by John Adams

“ Our Constitution was made only for a moral and religious people. It is wholly inadequate to the government of any other.”

as anyone with an attention span longer than what was once an average third grader knows, times up

Elrod · January 13, 2026 at 6:16 am

“I, and other prime and super prime users, will have to switch back to cash.”

Maybe not, at least for some of us. I have several cards and use them for cost-shifting; Card A (as you point out) gets me 5% back on groceries; Card B does the same thing for hotels; Card C gets me 5% back on Amazon purchases; and so on.

All have different account closing dates throughout the month; if I’m planning a large purchase I’ll, first, look for the best possible deal on it, then time the purchase to land on one of the cards the day after it closes for the month. That way I have about 7 weeks to actually expend the cash value of the purchase, 7 weeks that I’m cruising on someone else’s money while mine continues to earn interest (I have some fairly high return cash investment options among the 3 banks I use, plus investment accounts in various places). That does, however, require that I plan for that large purchase; sometimes that’s not an option. Which is why I also keep a cash emergency fund for, well, emergencies; that said, if it’s possible to “card” that emergency on one of the cards and buy 3-7 weeks of “free cruising” I’ll do that. I have been completely unable to find many businesses willing to knock off 5% for cash, but I always ask for a cash discount, for which I will do the math to see if it’s actually enough benefit to use cash, or if I’m still better off carding it. Small companies sometimes will give a cash discount, but try that at Walmart or Target and tell me how it goes. (I’ ve encountered a few companies that will reject cash payment offers – they prefer card use because a lot of their customers use debit cards which are the electronic equivalent of cash and almost all of the remainder use credit cards, which ease their bookkeeping, don’t have the risk of fraud from bad checks, and are easier to handle than cash; once I had to get the attention of a grocery store cashier when I tried to hand her a ten – she said I was the first customer of the day to not use a card, and it was about 11 AM, some companies don’t want any cash at all to prevent employee theft and robberies).

All of this requires that all my cards not carry a balance; for me, that’s easy, it’s how I grew up; for others, not so much because they have no understanding of the time value of money because no one ever taught them, they never encountered it during their educational years, or they simply aren’t aware enough (or bright enough) to take a few steps back and examine their particular situation.

I’m of the opinion that every single teacher and administrator in K-12 education should be fired and consigned to a lifetime of hard labor in a quarry turning big rocks into small ones because the entire system has been reconstructed to entirely benefit them and screw the students. Find a Home Ec class in any of today’s schools; find any school that’s teaching the basics of economics, including “how to balance a checkbook.” You won’t because that’s not what “educators” think is important.

And, today, there are few, very few it looks like, parents who have those skills to pass along to their kids. We’ve created several generations of Economic Illiterates and now we’re surprised that no one has money management skills.

None of this bodes well for our future, but it’s just one of several factors driving our demise.

Divemedic · January 13, 2026 at 9:39 am

I don’t think cards with rewards will be a thing after that point.

Schools don’t teach those things because we as a nation don’t think they are important. The new thing is getting the kids, all of them, into college so they can all have an above average salary.

Elrod · January 13, 2026 at 10:17 am

Absolutely true; too many think “college” is a Magic Talisman that cures all educational ills.

Separate issue: Have you considered allowing editing on comments? Probable wouldn’t work with the comment managing system you’re using, but it would be nice to be able to fix my xml mistakes (like all the %@&# italics above….)

Honk Honk · January 13, 2026 at 7:01 am

Credit is a construct of the white male patriarchy.

Michael · January 13, 2026 at 7:33 am

“Likely, this will eventually settle into digital currency becoming more popular. At that point, I will have to reevaluate my opinion of things like bitcoin.”

With the loss of cash to digital currency the power to see and even control what you are allowed to buy looms. Sorry Sir, you’ve bought your 100 gm of meat this week, transaction denied.

Seems Bitcoin has been decrypted in the EU

https://market-ticker.org/akcs-www?post=254740

And as 5 eyes includes EU and America, I suspect it’s here also, awaiting the right emergency to write “laws” to “protect Americans from criminals” or something.

Privacy in Credit card use isn’t good, I see a yearly free report on what I charged in categories, and I expect that a more defined list could be available for lawyers and Law enforcement.

Using DEBT CARDS online? What protection do you have to keep your entire bank account from going POOF?

If I have a dispute with my credit card, I call the credit card they stop the payment and more often than not my “money” or the services as priced occurs.

Is Trump trolling or is something else getting forced into an “emergency” for laws to get passed?

Divemedic · January 13, 2026 at 9:42 am

There won’t BE any credit cards at that point, debit, cash, or prepaids will be all there is.

SiG · January 13, 2026 at 9:01 am

Something I can’t help but notice (because it hits me regularly) is that more and more cards are wanting to drop those who don’t carry a big month to month balance. Perfectly understandable, but the implication is that enough people don’t carry a perpetual balance that the companies aren’t making the monthly income they’re expecting. Obviously, a perpetual monthly balance means more cash flow from the card’s interest.

Over the years, the two of us have had cards we no longer carry and I don’t remember details because it’s just not noteworthy, but we have three now (I think) and they’re both always offering incentives to stay in debt so they can count on more monthly income. Just this week, one of them – the Amazon Prime card – said they were going assess resetting my credit limit lower because we just don’t push the limit often enough for them. Yeah – they didn’t say it that openly. I’m sure they’re expecting, “Oh Noes! They’re going to lower my credit rating!” Rather than the “DILLIGAF?” they got.

Divemedic · January 13, 2026 at 9:45 am

The only issue I have had is banks canceling any card that I haven’t used in the past year.

Steve · January 13, 2026 at 11:50 am

We’ve encountered the same, @SiG. A couple have dropped our limits by 5 figures each (no panic — they are still 5 figures), and a couple have dropped us entirely. And it’s not the 842 FICO driving being dropped.

Danny · January 13, 2026 at 10:24 am

My wife uses a card for most everything – she gave me my own card for the account and I use it for a lot of general stuff – gas, groceries, hardware etc. She gets the freebies rewards – I never see any of that 😀

I’ve always figured if things really go tits up and I need a bridge – I’d use the credit cards that way. I did a few times over the years and it was PITA to get the balance back to zero.

Greg · January 13, 2026 at 12:33 pm

Want a good laugh? I’ll really date myself at the outset here. When I was a Boy Scout, we were taught to always have some change in our pockets in case we needed to make a phone call.

I agree with all of the above strategies, post and comments. I juggle three “cashback” cards, using them whenever and wherever possible like you DM. Even the 1% stuff adds up. I also pay them off every month without fail.

We worked long and hard to retire debt free, and I am OCD to the point of paranoia to stay that way. I pay not one thin dime of interest to anyone for anything. I carry enough cash to cover most ordinary purchases if for whatever reason the seller won’t take a card. I can still write checks if I have to, but with online billing for most utilities, I write very few anymore.

One last topic not mentioned above is that in every instance where the government currency becomes onerous or worthless, there arises a secondary, black market economy. Barter will be a backup plan for everyone.

Steve S6 · January 13, 2026 at 3:39 pm

That debit card does not have the protections that using a credit card does.

Damn the Commerce Clause anyway.

Divemedic · January 13, 2026 at 4:43 pm

Yet another downside to having shitty credit. There won’t be a choice if interest is capped at 10%

Debit card, maybe prepaid, or nothing, those will be the choices for e commerce

TRX · January 13, 2026 at 8:51 pm

Prepaid cards also have (depending on the issuer) activation fees, per-purchase fees, monthly or annual maintenance fees, and ‘reload’ fees.

“You can check out any time you like, but you can never leave.”

Divemedic · January 13, 2026 at 10:56 pm

My point exactly. That 10% cap won’t save anyone any money

nones · January 14, 2026 at 7:31 am

I do not even possess a debit card. If there is an issue with a credit card you are dealing with the cc companies money. Use a debit card and you are trying to get your own money back. You mention using a cc for utilities. I’ll have to look into that. Locally our fair city sells annual parking permits and charges 3% to pay by cc. I wonder if my local FPL does the same?

Divemedic · January 14, 2026 at 9:20 am

With 10% interest rates, banks will not issue credit cards to most people. Again, once credit cards are no longer an option, debit cards or prepaid cards will be the only things available for online transactions.

Stephanie · January 14, 2026 at 12:54 pm

The cap at 10% is only for one year. It’s meant to help those who want to get their credit card bills paid down or off in that timeline by having most of the payment go to principle instead of most of it going to interest. I’m not sure why you think giving people a chance to get into a better financial position, and giving them a strict timeline of one year to do it is a bad thing.

Divemedic · January 14, 2026 at 3:43 pm

Just think about this for a moment and apply reason to this:

1. If you were a bank, would you want to just take billions in losses for a year, or would you move to limit those losses?

2. If you were going to limit them, how would you do it?

3: Do you REALLY think, if interest rates were lowered that everyone would have the financial discipline to pay down their debt? If they cared that much about it, don’t you think they wouldn’t have run up the balance to begin with?

4: When has any government ever temporarily enacted price controls, and what would the public demand at the end of that year?

5: Do you think they would scream for the government to “do something” and not allow rates to go back to where they were?

Birdog357 · January 14, 2026 at 7:10 pm

Why do you think they banks would be taking a loss at all? 10% still exceeds inflation and it’s higher than what the bank loaned out and higher than prime so even if they took a loan it’s still a net gain.

Divemedic · January 14, 2026 at 8:10 pm

Because people default. You have to earn enough to cover defaults and cover administrative costs. Things like accountants, computer systems, IT, and all of the other overhead costs.

Birdog357 · January 15, 2026 at 3:43 pm

Do you think there would be more default with a 1 year cap?

Divemedic · January 15, 2026 at 4:08 pm

I think it would remain relatively flat

Stephanie · January 15, 2026 at 10:46 am

All true. But just to play devil’s advocate I suppose you would call it, one of the things they might do in response, that would affect you negatively, is to end the cask back rewards for card holders not holding a balance or ever paying interest at all, which you say you profit from in the thousands of dollars a year and seems a lot of other people do too judging by the comments. Not to be accusatory but to show that people in differing credit situations will view this issue differently.

Divemedic · January 15, 2026 at 4:07 pm

No, I feel like rewards cards are going to be a relic of the past

Treefarmer · January 14, 2026 at 2:43 pm

The Costco Visa with their Executive Membership is also a great cash back card. We get thousands of dollars back aech year by using the card for just about everything. You’re right, there’s nothing better than using a cash back rewards credit card to make tens of thousands of dollars in payments for things like a car, equipment, or large scale building material purchases.

Comments are closed.