I posted that I had been told a US sub sank a ship or possibly a submarine with a torpedo, but couldn’t confirm. It turns out to have been factual.

The Collapse

Sense

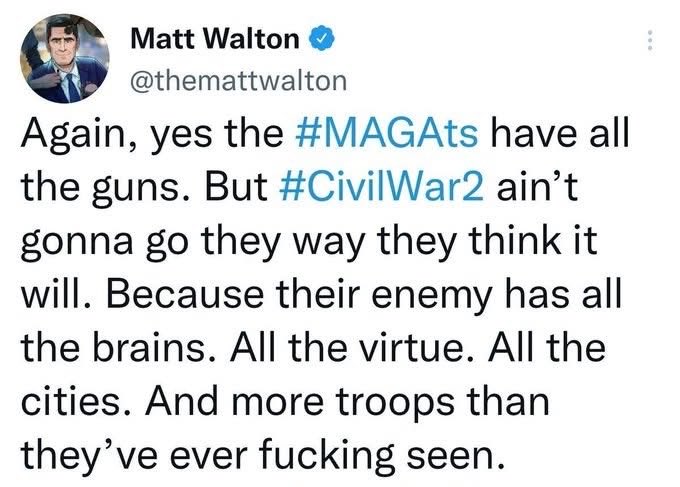

There is a segment of the left that wants a civil war. There is also one on the right that wants one. Both of those groups are delusional, because they both think the war will be short, and they will win.

Both sides are wrong. If there were a CW2 with similar casualty rates as the first one, we would see something on the order of 7 to 8 million dead and another million wounded. The majority of those deaths would be from disease and famine, not guns.

Still, this guy is a tool. They seem to think they will all be sitting in coffee shops, watching the military carry out their orders to wipe out their own families on CNN.

The reality will be much different. Cities would become disease infested wastelands once electric and water are cut off, and food deliveries stop. Some military units will simply desert their posts, taking weapons and gear with them. It would quickly degenerate into sectarian warfare.

No one really wins in such a scenario.

Me

Moving Into the Future

For the past couple of weeks, I have been transitioning from full time employment at one hospital to part time employment at another. There were physicals, credentialing, fingerprints, and background checks. What do you know, my new employer tells me that I had a positive quantiferon test. What this means is I have been exposed to Tuberculosis at some point since I was onboarded at my last job in 2023, and I now my body is manufacturing antibodies.

That’s pretty common in workers in emergency medicine, thanks largely to our homeless shitbag population. Contrary to what you have been told, being homeless isn’t something that happens to people through bad luck. No, the people who are homeless have a substance abuse problem, a mental health problem, or both. The person who just falls on hard luck is rare, and those who are homeless from bad luck rarely stay there for long. When I was homeless, it was caused by my ex-wife taking everything in the divorce, and I was homeless for less than a month. I think it was two weeks or so.

Anyhow, my old employer says that I could have been exposed to TB anywhere and I can’t prove otherwise, so they aren’t doing crap about it. This means that I will have to get a chest x-ray every year for the rest of my life, to make sure I don’t actually have TB. I’m gonna be like Doc Holiday.

After all of that was done, I had to begin my orientation and onboarding. It turns out that I know some of the instructors and a couple of the managers. The rest of the onboarding class was wondering how I seemed to know so many people.

Now I have to precept for a couple of weeks so they can finish training me on the new hospital’s policies and procedures. Then I drop down to working 4-6 days per month. Easing into retirement, as it were. I’m waiting to see if my old employer tries to screw me out of the PTO that I had banked (110 hours worth, so about 3 weeks’ pay).

Power Grab

Eye of the Storm

More and more evidence is coming out that the Democrats used both the Obama and Biden executive powers to deny Trump the office of President while he was a candidate, an incumbent, and again as a candidate. I think it’s obvious that there were state actors as well.

Additionally, segments of the executive and senior military officers were a part of this. It can’t be described as anything other than a coup being carried out by communists.

It isn’t over. The left is still on the move. Take all of the precautions you can. Like the eye of a hurricane, this is a short respite before storm conditions return.

Military

Reports

22 Pakis were killed while discovering US embassies are sovereign US territory guarded by armed US Marines.

I’ve also seen reports that, for the first time since 1945, a US submarine sank an enemy ship with a torpedo. Another report i saw says the ship sunk was a submarine stalking the Abraham Lincoln. I can’t confirm at this point. If it was in fact a submarine, this would be the first sinking of any submarine by an SSN. EVER.

Anti American left

Experts

The left are experts on everything. Now they hit every wrong answer on use of force in the comments here:

- Just shoot to wound

- shoot/use club to knock knife out of hand

- only shoot once, all he has is a knife

- he is too far away to hurt anyone

- he is outnumbered and the cops have body armor. The cops should Taser or tackle him

That’s as far as I could get before spraining my eye from rolling it so hard. This is a group of people who have never tried to deescalate a crazy or intoxicated person. This is why women and maggots shouldn’t be able to vote- they don’t reason, they emote.

Arts and Crafts

Keychain

The guy who owns it says it’s a crappy carabiner, because the gate fell off. It looks more like time in Federal prison to me.

Communism

Lowering the Bar

Remember when the left wanted to tax the rich? In liberal states, they are redefining rich downward– anyone making $125,000 a year will be taxed a state rate of 9.9% in Oregon. New York is going after those who make more than $125,000. Washington is adding wealth taxes to an ever lower amount of income.

Now they are even talking about stealing 5% of someone’s total net worth- on top of all of the other taxes.

Here is what Peter Schiff had to say about that, and it’s one of my favorite quotes:

If you tax 70% of what I make above a certain amount, what I am going to do once I hit that amount is simply take the rest of the year off, and furlough all of my employees. See you in February.

Anti American left

Promises Made

Susan Rice, President Biden’s domestic policy chief, is promising revenge against the voters, business executives, and appointees who support President Donald Trump.

In an interview this week, Rice declared that supporters of Trump can expect the proverbial knocks on their doors: “A very prominent public figure, who has served at nearly the very highest levels, once told me … ‘Revenge is best served cold,’ and the older I get, the more I see the wisdom of that.” She added: When it comes to the elites, you know, the corporate interests, the law firms, the universities, the media … it’s not going to end well for them, for those that decided that they would act in their perceived very narrow self-interest, which I would underscore, is very short-term self-interest, and, you know, take a knee to Trump.

They hate you and want you dead. Don’t forget that, as they compare you to NAZIs, Fascists, and call you deplorable, once they regain power as they eventually will, they will begin hunting down, killing, and imprisoning those with whom they disagree.

It’s coming, and all the election of Trump has done is create a small, temporary speed bump in their plans.