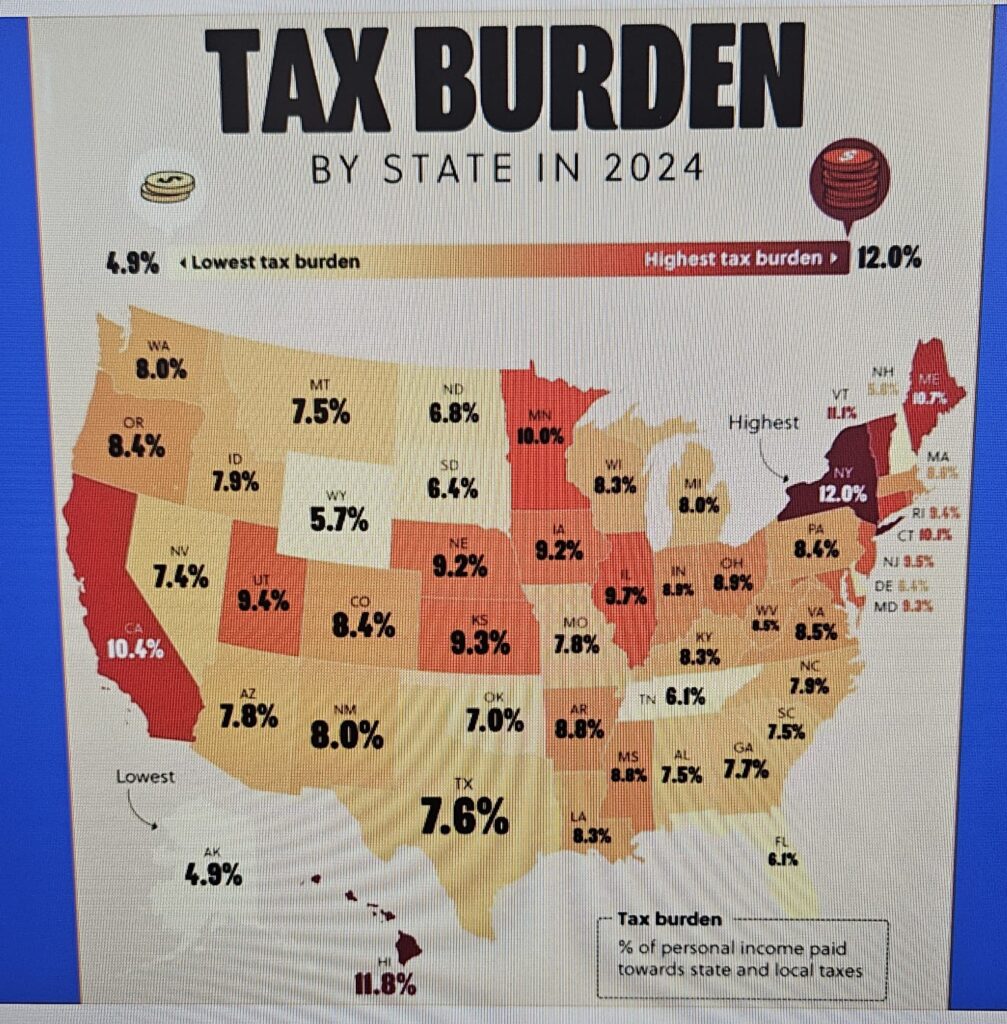

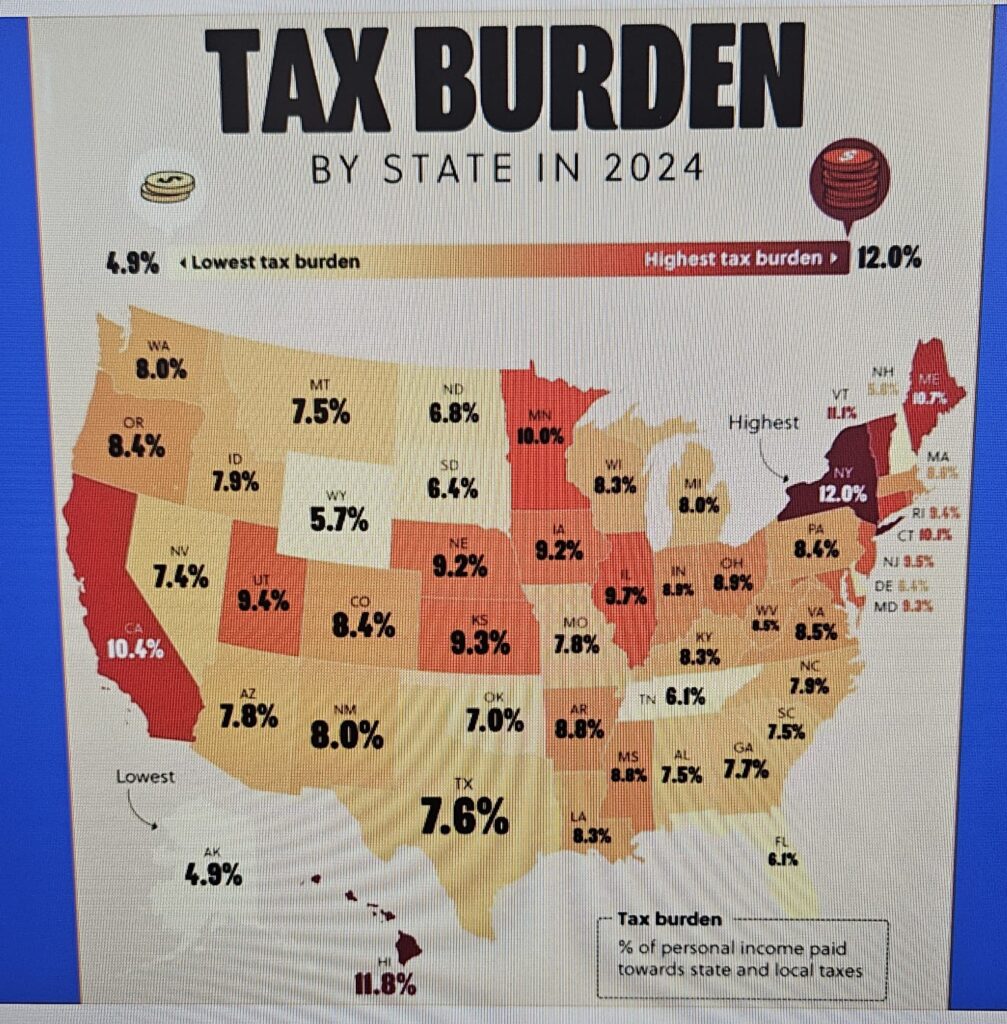

My wife sent me the following picture with the caption: This is your finance lesson of the day

The lowest 5 are:

- Alaska

- Wyoming

- New Hampshire

- Florida (tie]

- Tennessee (tie)

My wife sent me the following picture with the caption: This is your finance lesson of the day

The lowest 5 are:

8 Comments

Bluey · January 16, 2025 at 12:32 pm

Not being from the US, I recognise NY and CA for the highest rates, but not the others. Funny how the most blatantly left states have their hand in your hip pocket the most.

pchappel · January 16, 2025 at 2:25 pm

Huh, would be interested to see how that was calculated, but having escaped IL to TX I know it went down quite a lot. Perhaps being in the far North of TX and so outside of the big cities I am shielded a bit from more of the local taxes. But no income tax certainly is a huge advantage.

Strider Aragorn · January 16, 2025 at 6:47 pm

All of the high tax states are CPUSA (D) strongholds.

Workers (no ownership) ain’t cheap comrade.

I love the gun owners by state map.

lynn · January 16, 2025 at 8:14 pm

I am surprised. I thought Texas would have been in the lowest five. I guess that our property taxes are too high (they are !)

Aesop · January 16, 2025 at 10:36 pm

It’s wrong.

Califrutopia charges a top personal income tax rate of +/-10% (which “top rate” kicks in at a ridiculously low income number), and an additional 6-8+% (I’m too lazy to look up every county for exact numbers for each, which vary slightly) in sales tax on everyone. So the number hereabouts is more like 18%. Not 10.4%. Wee difference, no?

If they didn’t get that right, they were probably too lazy themselves to get the entire graphic correct, and never bothered.

Nevada, btw, has NO income tax, so that 7.4% must be business and/or sales tax.

And WY’s 5.7% isn’t exactly libertarian heaven either.

So that is unsourced graphic is more or less crapola.

Sorry, but there it is.

Divemedic · January 17, 2025 at 8:40 am

The income tax for most people appears to be 9.3% or less, unless you make more than $360k.

Sales tax doesn’t apply to groceries, medicine, and many other goods.

Aesop · January 17, 2025 at 1:58 pm

Which still begs the question of where they came up with the 10.4% number.

And sales tax here applies to everything else, and even worse for gasoline, which nearly everyone buys. Moreso in a state where nearly everyone drives, and a lot. My daily is nearly 40 miles, and I have co-workers that do 100 miles/day. When I was doing movie locations, 150 miles one way for me wasn’t an aberration.

I can’t even get away from CA’s sales tax on the ‘zon, who cheerfully collects CA sales tax on Gabbin Nuisance’s behalf.

Anyone who thinks the tax bite here, anywhere in this state, is only around 10.4% of their income is in for a rude surprise.

Also, the state under-collects at my paycheck, which is why I always owe them in April, whereas FedGov slightly overcollects, which is why their refund generally covers what I still owe Sacramento.

Since ever.

Joe Blow · January 17, 2025 at 6:10 am

Ha! I moved from NY to TN 9 years ago… Yes, my paycheck went up instantly. Not even filling out a form for the state on April 15th takes some getting used to, but by God you do.

Comments are closed.