There are those who think that I am being alarmist. They claim that inflation isn’t so bad right now, if you only ignore housing, food, and energy. Ignore the three largest expenses in every household, expenses that are more than 62 percent of the average household budget, and things aren’t so bad.

In 2020, Housing was 33% of the average American household budget. Energy was 16% of the budget. Food uses up another 13%. Nearly two thirds of the average American household budget was spent on those three items- items that the government doesn’t consider when calculating inflation.

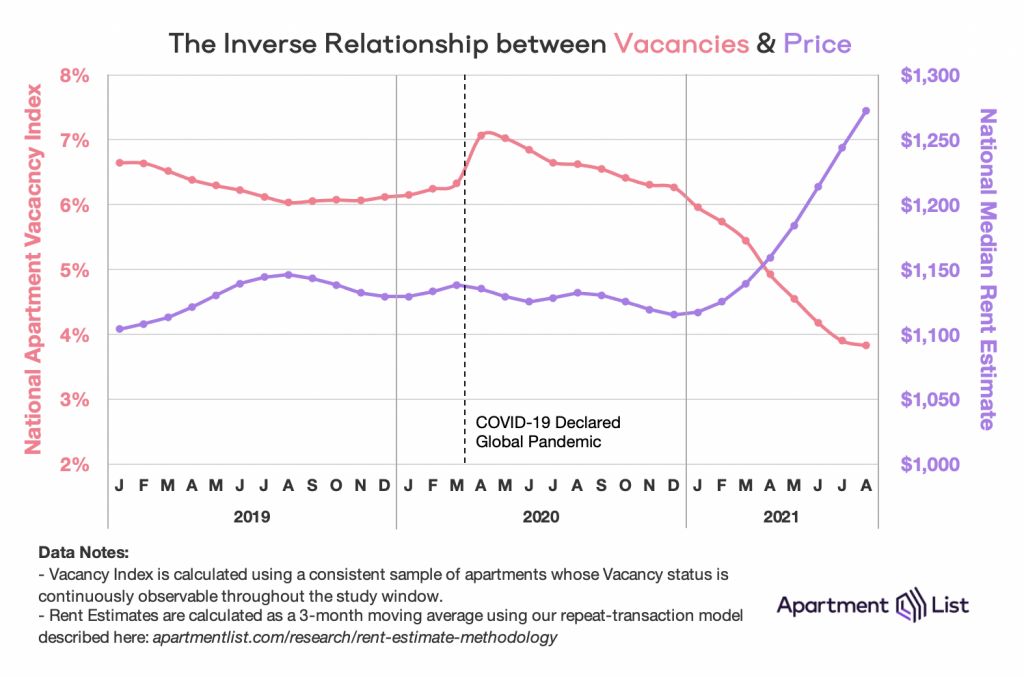

Housing is increasing. New home prices are skyrocketing (up 16 percent in the past year). With rentals, it gets more complicated. States like New York, California, Illinois, and Washington are seeing decreases in rent. Florida, Texas, Nevada, and Colorado are seeing massive increases. The largest is Henderson, Nevada, which has seen a 49% increase in rental costs in the past year. Orlando rents are up more than 25 percent in the past year, with most of that (20 percent) since January. Still, overall rents are skyrocketing with there being a nationwide 15% increase in rents over the past 8 months.

Food costs are rising, but in order to see that, you have to look past the official government statistics. (Hint: the government’s inflation numbers are no more realistic than the results of the 2020 election) According to Bloomberg (hardly a right wing source), food prices in July were up 31% from the same month last year.

What about energy? The average price of a gallon of gas was $2.11 in December, but that has risen to $3.09 as of last week. That is a 46% increase in 9 months. Other energy costs are also rising. The average cost of electricity has risen from 13 cents to 14 cents per kilowatt hour in the past year, a 7% increase. Overall, energy is costing Americans about 23 % more than it did last year.

So to sum things up: The weighted average of the increases in those three expenses is enough to put the actual rate of inflation at more than 12 percent, but that is area dependent. Some areas of the country are seeing inflation rates of 30 percent, and others are as low as 8 percent. Much of the variation is due to varying costs of housing and gasoline.

No matter what, the government reported inflation rates are far too low.

2 Comments

Simeon · September 10, 2021 at 10:08 am

In June 1lb of 93% hamburger meet was $5.50 at my local Target. In July they raised the price to $6.00. Last month it was $6.29. Yesterday I went in to buy hamburger for chili tonight. It’s $6.49.

Inflation is real and its getting worse on a month by month basis.

SiG · September 10, 2021 at 10:10 am

I love that graphic titled, “The Inverse Relationship Between Vacancies and Price.” They could have substituted “…Between Supply and Demand” or something closer to that.

But your point about inflation being measured so as to make them look good is right, of course, and people talk about using a multiplier of 3.5 times whatever the CPI says it is. Shadowstats.com keeps track of the CPI the way it was calculated in both 1990 and 1980. By the 1980 chart, his latest inflation number is about 13%, while its peak back under Carter was 15%. The 1990 chart is running 9%.

One of the reasons they do this is also that the Federal Cost of Living Adjustments (COLA) to Social Security (and other places, I’ve heard) are based on the numbers they report so they’re highly incentivized to lie there. Being truthful pulls more out of the house of cards.

Lying about inflation always benefits the money printers who are deliberately creating inflation.

Comments are closed.