This article has hit my feed several times recently, and the author is either deliberately being deceptive, or she is just a moron. The headline reads: “I Asked ChatGPT What Would Happen If Elon Musk Paid Taxes at the Same Rate as the Middle Class” The claim is made in the article that Musk only pays a tax rate of about 3 percent, because his net worth increased so much.

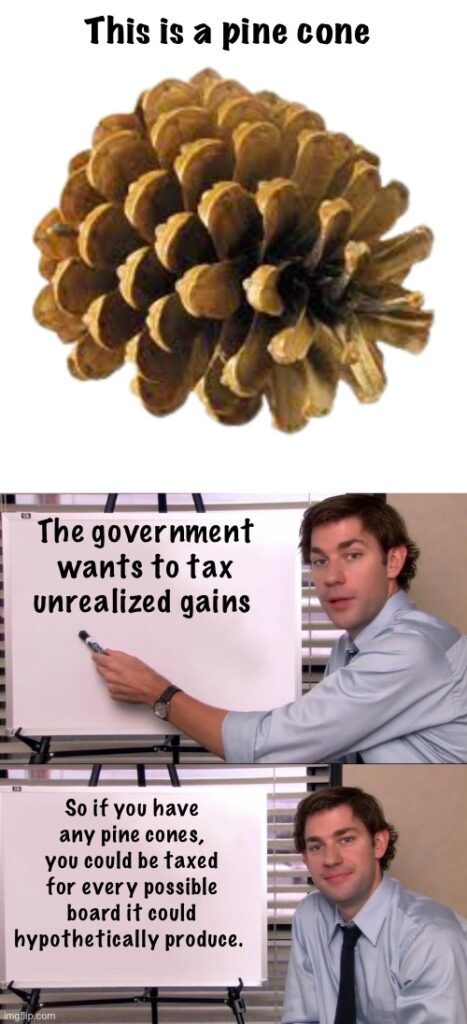

The article claims that Musk can dodge taxes by using the value of his assets as collateral to take out a loan, which isn’t taxed. They are demanding that we tax people on the unrealized gains of their assets, because rich people something something.

The author is comparing apples to Volkswagens. The middle class, for the most part, pays taxes on income. It’s right there in the name: Income Tax. In the article, you are talking about taxing the rich on their wealth. It’s two entirely different concepts. If the two were equal, the middle class would be paying taxes on the value of their house, not on what they make.

As an example, let’s say that an average guy and his wife are making the US median income of $80k. They have two kids, take the standard deduction, and are thus paying $9400 in income tax, plus Social Security, Medicare and other payroll taxes totaling $11,752. That makes this family’s effective tax rate 14.69%. However, his house is worth $40,000 more than it was last year. That $40k is an unrealized gain, and this lowers his effective tax rate to 9.7%.

Now look at Elon’s taxes. They are screaming that his wealth increased by $86 billion in 2021, but he “only” paid $8.6 billion in taxes. They don’t say what he actually made, just what he is worth. It just isn’t a proper comparison.

My opinion here is that the powers that be desperately want the ability to tax wealth. Currently, this isn’t permitted because the 16th Amendment only permits the taxing of income, not wealth. Once they get the power to tax what you own, and not just what you make, there is no limit to what all of us can be taxed on.

- Your retirement account? 2% annual tax

- Your house? 4% annual tax

- You have a collectable car? taxed at 5% of its gain

The beauty of this, is that even if your unrealized gains are adjusted for inflation, the official rate of inflation is lower than the actual rate. So if they let you deduct 2% of your unrealized gains as being inflation, but the actual rate of inflation is 5%, you will pay taxes on that extra 3%.

This will make all of us poor in no time.

11 Comments

Michael · August 2, 2025 at 7:05 am

But, But, But IF you can “PRINT” dollars with a mere stroke of a computer WHY do you have to Tax Me at all?

Sarc in case you thought I was serious.

Printing money creates more dollars chasing the same apple (or whatever). Inflation via the debasement of a nation’s money is older than Rome although the ever-shrinking silver in the Roman Denaris as well as foolish wars all over did kill off Rome.

The power to tax is the power to CONTROL and Destroy. Gov.com likes something? Less or no taxes, Gov.com hates something but cannot directly ban it then tax it to death.

Poor people are easy to control.

I fear that the death of physical cash for E-Dollars, Stablecoin linked to the US Dollar, and such are electronic chains where there is NO Finacial Privacy.

It’s going to get worse sooner than later friends with the ever growing debt bombs and bond nightmares going on.

it's just Boris · August 2, 2025 at 7:36 am

“But, But, But IF you can “PRINT” dollars with a mere stroke of a computer WHY do you have to Tax Me at all?”

That is, in fact, an excellent question to ask anyone spouting off about “Modern Monetary Theory” and how great it is.

Don in Oregon · August 2, 2025 at 9:33 am

Also … how many living wage jobs do Elon’s businesses provide? How much do Elon’s businesses pay in property taxes, employment taxes, etc?

Exile1981 · August 2, 2025 at 10:05 am

Canada is going to have an annual tax on unrealized gains shortly. We already have it when you sell your house but now we’ll have it annually to “fight the deficit”. It will destroy the middle class, which is the real purpose.

Honk Honk · August 2, 2025 at 10:08 am

Chat GPT? The magnificent cloaca.

The logo reminds me of that.

AI be like all smart n’ stuff.

GIGO

Rick T · August 2, 2025 at 9:45 pm

They will pound on Musk all day, but nary a mention of Warren Buffet, Michael Bloomberg, Bill Gates, George Soros, or Klaus Schwab as targets for the net assets tax instead of Adjusted Gross Income.

Chewie · August 3, 2025 at 2:48 am

Occasionally I can’t help myself and I go look at articles like this one. I did that in this case. Another thing I do is scan the comments to see how fucked we really are. At times I see something that restores my faith (or dials down my cynicism) just a little bit.

This comment wins the internet so far for the morning:

Dennis

30 July, 2025

I asked Chat GPT about articles by people who quote Chat GPT. Chat GPT gave me a long list of reasons why those articles are misleading and should not be accepted at face value. Here is what Chat GPT says about these articles “They often misunderstand what this tool is and treat it like some kind of AI oracle instead of what it actually is—a conversational assistant that gives useful answers based on what it’s asked and how.

It’s like asking a Magic 8 Ball a loaded question, getting the answer you wanted, and then publishing it in a think piece.” and “You’ve probably seen the headlines:

“We Asked ChatGPT If [Insert World-Changing Issue], and Its Answer Might Surprise You.”

Or worse: “ChatGPT Says [Insert Oversimplified Take] — What Does That Mean for [Everything]?”

Let’s be honest: these articles are the literary equivalent of asking your microwave how it feels about global warming.”and The Real Problem. The problem isn’t ChatGPT. The problem is lazy writers using it as a shortcut to seem insightful:

Don’t want to research an issue? Ask ChatGPT!

Want a quote to back up your take? Ask ChatGPT!

Need an “expert opinion” with none of the credentials? Boom—ChatGPT!

It’s like outsourcing your thinking to a mirror.

Thanks for taking time to do this blog!

Chewie

Biff · August 3, 2025 at 10:00 am

(Sorry this is posted late, had trouble with the login. And no, I didn’t mean to audit you, but as a tax professional with 40 years of experience, sometimes I have to speak up.)

I love your insights and analysis, but your tax numbers are wayyy off. Standard deduction in 2024 for Married Filing Jointly was $29,200, so that leaves $50,800 in taxable income. Going to the tax table, the first $23,200 is taxed at 10%, the rest at 12%, so actual tax is ($2,320+$3,312=) $5,632. Assuming the kids were under 17 and the rest of the rules were met, they will also get Child Tax Credits of $2,000 per sprog, so their tax liability is now ($5,632-$4,000=) $1,632. (They are probably getting a refund check because (barring any shenanigans with W-4 withholding) it is extremely unlikely that they paid in less than that amount through their paychecks. All this means that the average family earning the median annual income of $80,000 pays $1,632 in income tax, for an effective tax rate of….drumroll…2.04%!!!

How does this compare to those evil high income folks? Let’s take one as an example. For simplicity’s sake, let’s take the same family and just add a zero, making the income $800,000. Applying the standard deduction drops their taxable income to $770,800. The same tax table calculates tax as (23,200*.1)+(71,100*.12)+(106,750*.22)+(182,850*.24)+(103,550*.32)+(243,750*.35)+(39,600*.37) = $211,322, for an effective tax rate of…drumroll…26.4%. Note that they get NO Child Tax Credit as their income is too high. But wait, there’s more! As their income is over $250,000, they are also subject to the additional Medicare tax of .9% on all wage income over $250,000, so add another $4,950 in tax, making the total tax liability $216,272 and the final effective tax rate…27.04%…over THIRTEEN TIMES the tax rate of the median family. Taking this a step further, if you divide the high income tax bill by the median tax bill, you get (216,272/1632=) 132.5. The high income family has the income of ten other families but pays as much tax as 132 other families COMBINED. Are the high incomers paying their “fair share”?

Payroll taxes are often pulled into these comparisons, but that is like comparing apples to outhouses. Federal payroll taxes (Social Security, Medicare, and employer-paid FUTA) are not general fund taxes, instead they (theoretically) accrue a specific benefit for that taxpayer. Social Security was originally sold to us as a personalized retirement system, where what you paid in determined what you got out of it. In reality, the income benefits and taxability are heavily skewed towards the lower income segment, and that just keeps getting more skewed over time. Compare the after-tax benefits received by someone earning the minimum wage for 30 years vs someone earning at or above the wage cap for the same 30 years, and you’ll see the minimum wage earner gets about FOUR TIMES the return on their contributions. For many higher earners, they actually LOSE MONEY on their Social Security “contributions”. DO NOT include Social Security when discussing income tax burdens.

Medicare is even worse, because it is a cliff benefit. If you meet the criteria, you get benefits; if not, you get nothing. Qualifying for Medicare requires taxable wage income of (currently) $7,240 per year for ten years. Given the federal minimum wage is $7.25 per hour, that equates to just under 1,000 hours of work per year, or about 20 hours per week flipping burgers or mopping floors. Medicare tax rate is 1.45%, paid by BOTH employer and employee, so 2.9% total. Apply that to the qualifying amount yields an annual cost of $210, multiplied by the ten year payin requirement equals minimum total cost to buy into lifetime Medicare = $2,100. OMf*ngG. That is close to what a current Medicare retiree has to pay each year just for Part B premiums. Now let’s compare this to the other end of the income spectrum. Let’s pick on Elon Musk and assume he gets a paycheck from Tesla or whatever for $1,000,000,000 – yup, a billion bucks. Medicare tax HAS NO INCOME CAP, so he (and Tesla) are paying 2.9% on the whole paycheck – $29 MILLION in Medicare tax!!!! That is 13,800 TIMES the tax paid by the minimum wage person, and yet they would both would get the exact same medical care. Granted, those are extreme, but still, how is that “fair share”? DO NOT include Medicare when discussing income tax burdens.

And I guess that’s enough of that for now. Thanks again for an extremely interesting series of blog topics.

Divemedic · August 3, 2025 at 11:07 am

The purpose of the post wasn’t to calculate someone’s taxes, but was to illustrate the point that including unrealized gains alters the effective tax rate to the negative. The numbers that I got were from a publicly available tax calculator.

In your haste to prove your knowledge of the tax code, you missed the entire point of the post.

Perhaps your thoughts on the difficulties of using unrealized capital gains in calculating taxes would have been more on point.

Dan · August 3, 2025 at 8:32 pm

I constantly hear the statement that the Uber rich don’t pay income tax because they take out loans against their assets and don’t have to pay tax on those loans. But these claimants never take this to the next obvious step. How the hell do they pay back those “loans”….the lenders expect their money back….WITH INTEREST. How does this actually work? Inquiring minds need to know.

Socialists Clueless About Economics – Area Ocho · August 5, 2025 at 4:56 am

[…] Books have been written about this, and I am not writing a book here. I had one reader respond to a recent post that mentioned income taxes with a comment that stretched into 1,000 words, explaining that I had calculated the taxes […]