This article in Fortune correctly states that the $1 trillion in interest payments is problematic, but I think they understate the scope of the problem. The Federal government collects about $5 trillion a year in taxes. That’s a lot of money, but it isn’t enough. For decades, the government has spent an average of $1.45 for every dollar it collects in taxes.

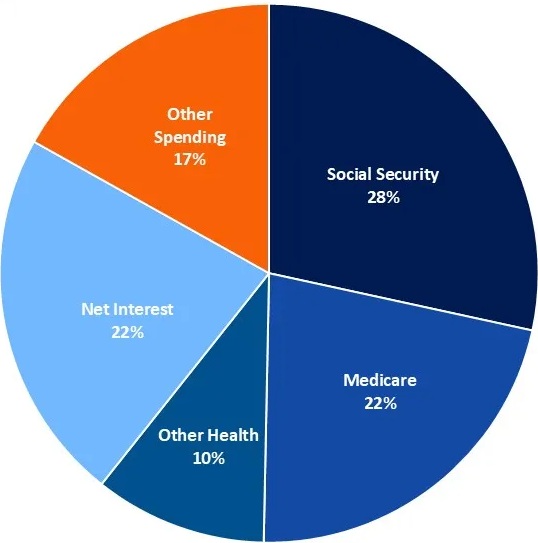

The majority of it goes to so-called ‘mandatory spending’ and interest on the money that we have already borrowed. Mandatory spending includes entitlements like Medicare, Social Security, VA benefits, etc., which are REQUIRED by law to be paid. Interest on the debt must also be paid. Entitlement spending (Social Security, Medicare, Medicaid) accounts for about two-thirds of the federal budget, and interest on the debt that we already owe brings that to just over 83% of the budget. Entitlements are mandatory spending, meaning they’re on “autopilot,” growing automatically based on eligibility rules set by Congress, unlike discretionary spending.

All of the other spending: Welfare, Food Stamps, the Military, the Courts, jails, etc., account for the other $2.3 trillion of Federal outlays.

It’s just unsustainable, and anything that can’t go on forever, won’t.

5 Comments

Anonymous · December 18, 2025 at 8:17 am

Actually, it was more than a trillion in 2025. We are now in Federal budget year 2026 and the interest is on track to be 1.25 trillion. By 2030 interest will be larger than all social spending. It is called a debt trap for a reason, and the trap is about to spring shut. Europe has the same problem but even worse. This is the driving force for politicians running the EU and their relentless push for a with Russia as a distraction for the tax slaves.

Milton · December 18, 2025 at 9:04 am

Anything that can’t go on forever, won’t.

Here is a pretty good analysis, https://www.myrmikan.com/pub/Myrmikan_Research_2025_12_15.pdf

which concludes with…

The only hope for civilization is liquidation, and not just of the market. We need

to liquidate the Fed, liquidate the currency system. The market is already doing so to

the dollar internationally, with gold returning to its role of balancing trade and being

the preeminent reserve. As individuals begin to shift their personal reserves into

gold, the dollar will becoming increasingly irrelevant domestically as well

godhelpus · December 18, 2025 at 10:41 am

We are already mathematically, broke beyond redemption. The off the book obligations are more money than most of the world generates. Despite that we continue to spend trillions of dollars a year, a lot of it for foreign governments, fraud, corruption, etc. It is such insanity at this point that it doesn’t even really deserve discussion. There is no fixing it. The only thing that currently keeps the United States economy from completely collapsing is the illusion that the currency has any value. The dissipation of the illusion will start with other world governments jettisoning the dollar as the global standard then the United States economic collapse will follow. I think of all the potential collapses that preppers should worry about, economic collapse should be number one. It’s simply a matter of time not if.

Joe Blow · December 18, 2025 at 2:46 pm

A trillion here, a trillion there… after a while, you’re starting to talk about some real money.

Danny · December 18, 2025 at 8:15 pm

But won’t Bitcoin save they day? 🤣

Comments are closed.