Fact of the day: 80% of the children born in New Orleans are funded by Medicaid. In fact, 24% of the population is covered by Medicaid, at an annual cost of $4.4 billion.

Uncategorized

Irony

The government, through the Department of Agriculture, is distributing more food stamps than at any other time in history.

Meanwhile, the Park Service, another branch of the government, tells us not to feed the wild animals in the park, because they will become dependent and lose the ability to fend for themselves.

Uncategorized

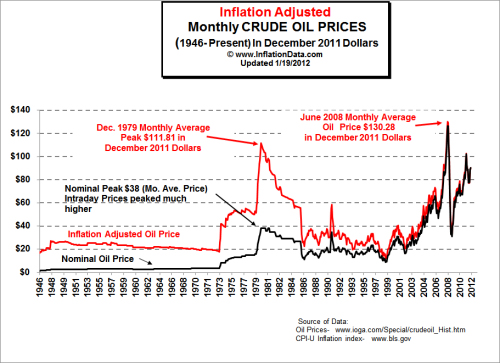

Oil prices

This news report talks about rising gas prices and states that for every $50 you spend on gas:

$30.75 goes to the oil company

$7.00 to the refinery

$6.00 goes to the government

$4.00 to the distributor

$1.25 goes to the credit card company

$1.00 to the gas station

The entire article insinuates that the oil company is being greedy, but how fair is that?

$50 in gas, with prices around $4 a gallon, will get you about 12.5 gallons. There are 42 gallons to a barrel of oil, so your $50 in gas becomes slightly less than a third of a barrel of oil. Oil is currently about $110 a barrel. A third of that is about $33, which is about what you pay.

What changes the price of oil? In this case, blame the dollar. The government is not counting the price of fuel or food when they calculate inflation. The government is spending so much that the dollar is losing value, which is increasing the price of goods bought overseas, and the number one imported good is—- gasoline.

Blame profligate deficit spending for the pump prices.

Uncategorized

Never doing that again

While I was doing my taxes, I was playing with Quicken and decided to see what living in my house cost me. I “bought” that house in 2007 for $236,000. Two and a half years later, it was worth only $96,000 and I declared bankruptcy to get that albatross from around my neck. When all was said and done, it came out in court that no one could tell me who owned the mortgage on that house, and so I won a “free” house in court.

Out of the five years since I bought it, I have not paid a dime in mortgage payments since September, 2009. Even so, that house has cost me $44,254 in mortgage payments over the last 5 years. Other expenses for the last five years:

Homeowner’s Association: $1,591

Electric bills: $15,471

A new air conditioner/ heat pump: $4,219

Household maintenance, landscaping, and lawn care: $11,152

New appliances on moving in: $5,408

Insurance: $5160

Property taxes: $6341

That is a total of $93,596 for 58 months. That works out to $1,613 a month. Now keep in mind, I haven’t made payments on that house for half of the time I have been there. If I had been, the monthly cost would increase to about $2,300 a month.

Now, to be truthful, I would have to pay utilities in an apartment, but I included them above because I have never had an apartment with $400 electric bills, which were not all that unusual in this house.

The five previous years in an apartment cost me an average of $1234 a month, including utilities and renter’s insurance. My apartment was nice. It was only 200 square feet smaller than the house I bought, and it had a garage. Does anyone think that the tax advantage of owning a home saves you $14,000 a year in taxes? Not even mentioning that the house is worth $142,000 less than I borrowed on it. Had I not filed bankruptcy and gotten that house, I would still be upside down on it. I am not repeating that mistake. I will rent from now on, thank you very much.

Uncategorized

Why use banks?

I was reading this article about a young man who had a savings account with less than $5 in it who racked up over $200 in banking fees. With a balance of $4.95, he was charged a $9.95 account maintenance fee, and this caused the account to overdraft, thus triggering a $28 per day overdraft fee. By the time he was notified by mail of the problem a week later, he had racked up $229 in fees.

This got me to looking at my own account. Banks used to be an excellent way to protect your money. You placed your money there for safekeeping, and the bank paid you a small amount of interest for the privilege of being able to lend your money to others. Checking accounts, not being available for lending, typically charged a small fee for the convenience of keeping your spending money safe.

Not any longer. At prevailing interest rates, you are only earning about $1.50 a month on a $10,000 savings account. So at the end of a year, you have exposed your ten grand to the risk of being stolen by the government via inflation, and by the very company that you have entrusted your hard earned money with through the use of fees and charges, all for the token sum of $18. An account of $10,000 earns $18 in interest in a year, but loses hundreds of dollars in value from inflation.

What I have done instead is to leave operating funds in my checking account, which being direct deposited at a credit union, lets me avoid banking fees. I keep one month’s expenses in a savings account at the same credit union, which gives me a measure of insurance against overdrafts and small to medium unexpected expenses on short notice, and I invest the rest.

Now remember that gold typically holds it value against inflation. That is, an amount of gold will hold its value when measured against inflation, with the exception of small, short term variation and broker fees. It is those fees and variations that must be accounted for. For example, I bought gold when it was $1370 per ounce in September of 2010. There is a small premium for my preferred form of gold, and along with broker’s fees, I paid $5400 for 4 ounces of gold.At today’s price, I could sell that 4 ounces for roughly $8900- a profit of $3400, which is an annual return of nearly 200%.

Now today is a down fluctuation time- time to buy more. Gold has fallen almost $150 per ounce in the last 30 days. That is not a bad thing. As I write this, gold is down to $1580 an ounce, as the dollar increases in strength due to the impending collapse of the European Union. This means that we can buy gold at rock bottom prices. I am thinking of grabbing a few ounces this week or next, and catching it near the bottom.

Once the United States crashes in similar fashion (which is inevitable, considering the way we are emulating the out of control spending of Europe) people left with dollar denominated assets (stocks, bonds, savings accounts) will find their savings evaporated by inflation, while those holding assets like metals, oil, and durables will find that they have held their value.

The big downside here is physical security. I have a large, heavy safe, a cell phone connected burglar alarm, motion activated security lights, and numerous other security measures. Add to that the fact that there is an armed guard residing on the premises (me), and this is a pretty secure facility.

Use banks for short term liquidity, hold hard assets for long term savings. So here is my advice:

1 Get rid of all of your debt.

2 Establish a short term emergency fund of 1-2 month’s expenses (not income).

3 Have at least one month’s worth of food and needed supplies in the house.

4.Go easy on the luxuries like dining out, video games, expensive electronics, etc.

5.Save money in hard assets. (Things that hold their value that you can readily sell or trade for things you need)

6.Pay for a place to live in full. If you are making payments, you don’t own the house, the bank does.

Uncategorized

Spend it like it isn’t yours

As of November 30th, the National Debt stands at a whopping $15.1 trillion. It took the Obama administration less than three years to borrow $4.5 trillion, what it took the Bush administration 7 1/2 years to borrow. In nearly every measurable way, the Obama administration has been even worse for the country that Bush was. Why isn’t the press reporting on this?

Uncategorized

Too many degrees

Have you ever heard that you need to go to college to get a good job? I know that I did. Heck, my parents practically tied me up and took me to the military recruiter because I didn’t go to college. The reason that our parents thought that college was so important is because of how well college graduates did in college.

In 1950, only one third of the adults in the United States had a high school diploma. Many of the adults were blue collar factory workers and made a good living. Only about 1 in 20 adults had graduated from college.

That was before education became big business. School became easier, and kids were passed on to the next grade, not because they had mastered the skills needed, but because teachers were afraid of damaging the kids’ self esteem. In 2010, 80 percent of adults were high school graduates, and 20 percent had a 4 year degree or more.

So the latest generation is flush with college degrees that mean little, because many schools are offering degrees in things that are not needed job skills. Because we have all of these degrees, we are demanding high wages, and this has driven the blue collar jobs out of the country. Unemployment is rampant. At the same time, we are paying people the equivalent of $10 an hour to sit at home for up to two years, so there is little to no incentive for work.

Instead of making things like cars and appliances, we sit around and make war and college graduates with degrees in French Poetry and Women’s Studies. We spend money like there is no limit, and for that we are doomed. Soon, we will reach the nation’s credit limit, and our time as the world’s superpower will be over. I find myself wondering how hard the times that are coming will be.

Uncategorized

Two year anniversary

I also just realized that today marks the two year anniversary of my bankruptcy filing.

After finding myself owing $240,000 on a home that was only worth about $120,000, and trying to get some help from the banks that were flush with billions of bailout money, I decided that I could either be stuck with 27 more years of mortgage payments totaling over half a million so that I could own a home worth less than $100,000, or I could do the financially wise thing and walk away, I decided to declare bankruptcy.

It was a wise decision. It turns out the bank had sold my loan to 3 other banks at the same time, so no one knows who really owns the loan. They cannot find the loan paperwork, and it turns out that there are no bank records showing who owns the loan, so I still own the home even though I haven’t made the last 25 payments. The bank lied in court, and provided forged papers to try and prove that I owed them money. They got caught, I sued them, and won a not insubstantial pile of money.

I have no debt, a 3 year old, paid for in cash pickup truck, and $40,000 in savings. I have no debt. My credit score of 655 isn’t too bad, considering a two year old bankruptcy.

Uncategorized

A lot of cash

I haven’t mentioned this on over a year, but I want to take a look at the US debt. As of today, we are $14.9 trillion in debt, according to the US treasury.

When Obama took office, that amount was $11.9 trillion. An increase of $3 trillion (or 140%) in just 33 months.

When GW Bush took office, we had a national debt of $5.7 trillion. The debt increased $4.7 trillion in 8 years. This means that the Obama administration is just $400 billion shy of borrowing in 3 years what it took his predecessor 8 years to borrow.

Not like I am really happy with Bush’s spending, either. Or Clinton’s.

Uncategorized

Gold experts and inflation

Gold tops $1900 an announce, and the experts are all claiming that it is overbought, and that the bubble will soon burst.

That is the same thing that the experts said in June, when gold was at $1500 an ounce.

– and October of 2010, when gold was $1380 an ounce.

– and March, 2010, when gold was at $1200 an ounce.

– and December of 2009, when gold was passing $1100 an ounce.

– and in December of 2005, when gold was $520 an ounce.

The secret here is that the world’s governments and private citizens alike are coming to the realization that the US Government cannot stop spending money, and are moving away from using the dollar as the reserve currency for the world. This is injecting large amounts of dollars into the world’s markets, and making the dollar worth less. This is causing a massive devaluation of the dollar. This isn’t the first time that a country has spent itself into financial ruin. Zimbabwe, the Soviets, and the Germans have all done it during the last century.

Our politicians don’t care, because both parties need your money to buy your vote. They are spending us into ruin. Don’t be caught holding dollars when the end comes, or you will need them to heat your home, like this woman is doing in 1923 Germany, because bank notes are cheaper than coal.

Price of 1 ounce of gold (in German Marks):

January,1919………. 170

September,1919……. 499

January, 1920………. 1,340

September, 1920……. 1,201

January, 1921………. 1,349

September, 1921…….2,175

January, 1922……….3,976

September, 1922…….30,381

January, 1923……….372,477

September, 1923…….269,439,000 (that’s right- from 4 thousand to 270 million in a year and a half)

Oct. 2, 1923………….6,631,749,000

Oct. 9, 1923………….24,868,950,000

Oct. 16, 1923…………84,969,072,000

Oct. 23, 1923…………1,160,552,882,000 (over 1 trillion)

Oct. 30, 1923…………1,347,070,000,000

Nov. 5, 1923…………..8,700,000,000,000

Nov. 30, 1923…………87,000,000,000,000 (almost 80 trillion increase in one month)

Do you see how the problem escalates? This is where we are headed. Scary stuff.